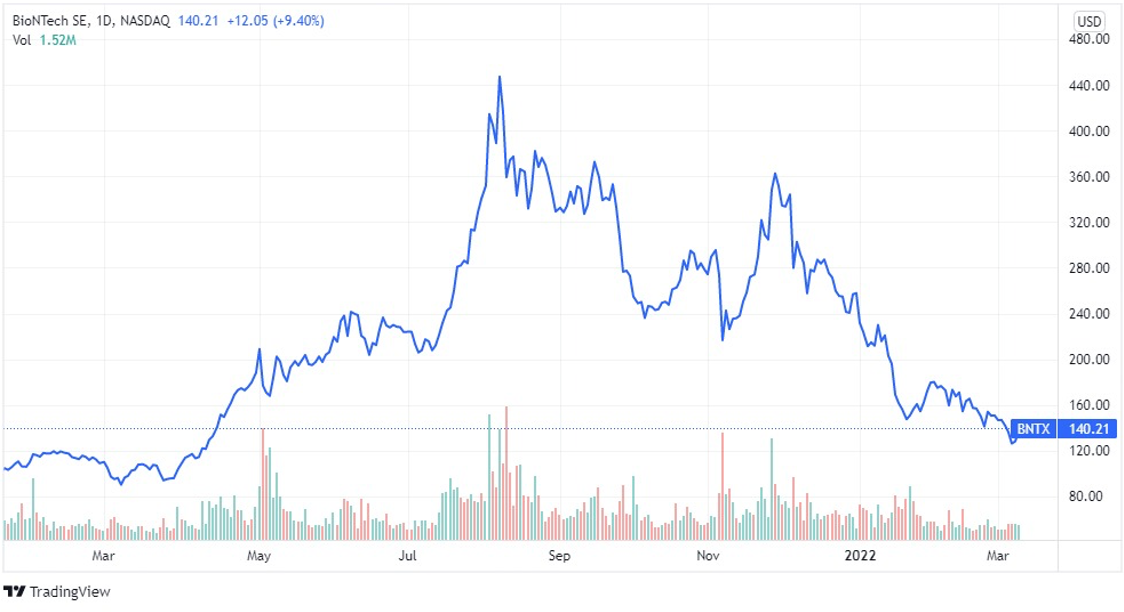

BioNTech, the German biotechnology company which joined forces with Pfizer to create one of the most renowned COVID-19 vaccines, has struggled to escalate in value since the end of 2021. What went wrong, and how does the future seem?

Recent Performance & Q4 Forecast

In the third fiscal quarter of 2021, ended on September 30th, BioNTech delivered extraordinary results. Earnings per share (EPS) were $14.56[1], against the $11.79 expected by a consensus of several analysts, according to Zacks Investment Research. The biotech pioneer announced net profits of €3.2 billion ($3.7 billion), with total revenues standing at €6.1 billion generated in the three months of July to September, against a mere €67.5 million in the same timeframe last year.

The main reason for such impressive figures was the rapid global rise in the supply and sales of its popular Comirnaty vaccine, which it has created with the renowned Pfizer. The company delivered over 2 billion doses as of the 2nd of November, as it attained approvals from several regulatory authorizations to bolster capabilities, research potential, product shelf-life and more aspects of the business and its offerings.

The company, which was co-founded by the children of Turkish immigrants to Germany, believe that it shall manufacture up to 4 billion doses in 2022[2], with analysts from Yahoo! Finance expecting that the EPS of the firm will hit $8.27 and revenue to amount to $4.35 billion on average.

The Drop

BioNTech (NASDAQ: BNTX) has been trading lower since December of 2021, up until the present. Let’s examine the series of events which contributed to the infamous decline of BioNTech;

Underplaying Omicron: On December 8th, BioNTech & Pfizer shares began to slide lower, despite reporting that a laboratory study exhibited that the third dose of their COVID-19 vaccine neutralizes the Omicron variant. Despite that, prospects of the adverse impact of Omicron on the globe, and hence more vaccine sales, were weak, which slid the shares lower.

Fading Confidence: In late December, BioNTech shares continued to trade lower, as the company, alongside Moderna, slashed its COVID-19 sales forecast, which prompted investors to turn bearish and sell their BioNTech holdings.

Ineffective Vaccine: Towards the final week of January 2022, clinical tests in Israel found that the fourth dose of the COVID vaccine did not prevent infection of the Omicron variant. This has sunk their already downward-trending shares by 13% in a span of three days.

Looking Beyond the Pandemic: In early 2022, retail & individual investors appeared to be looking beyond the biological pandemic, despite strong and sturdy vaccine sales of not only the BioNTech-Pfizer alliance, but also those of other prevalent vaccine-makers, including Moderna, AstraZeneca and Johnson & Johnson to name a few. The same occurred in February, with BioNTech shares declining 18% in the month.

Good News, Bad News: As COVID-19 cases and the pandemic as a whole is being overlooked, and regarded as a disease we can co-exist with, this serves as great news for mankind, but bad for vaccine makers. The BioNTech stock edged over 4% lower in March, and a concerning 40% since the start of 2022.

Future Expectations[3]

Looking into the future plans of BioNTech, they mainly revolve around two main endeavors, other than expanding its vaccine manufacturing. First, the company plans to initiate the construction of mRNA-based vaccines in the African Union in the middle of the current year. This marks as a great step towards implementing sustainable end-to-end vaccine dose supply solutions in Africa.

Second, the firm is expected to spurt funds, energy and efforts towards its pipeline project. BioNTech has already been pouring investments into research and development, with the goal of advancing multiple projects at the same time. Should this happen, it shall bolster the company’s momentum and present it as a valuable company beyond the pandemic perspective.

Analysts from reputable financial institutions, including Goldman Sachs and Morgan Stanley, expect the BioNTech stock to hit $273 on average, with a high target of $400 and a low estimate of $146. The average consensus sentiment, yet, advises investors to hold the stock, so it’s best advised to wait for a better entry point before buying the BioNTech stock.

[1] Past performance does not guarantee future results.

[2] Forward-looking statements do not guarantee future development.

[3] Forward-looking statements do not guarantee future development.